|

In recent times, many Tennessee residents have been feeling the pinch of rising costs and economic pressures. According to various reports, credit card delinquencies have surged as individuals struggle to manage their finances amid inflation and increasing living expenses. For those facing overwhelming debt, finding a viable solution is crucial.

Rising Credit Card Delinquencies Recent data highlights a troubling trend: credit card debt has reached unprecedented levels, and delinquency rates are on the rise. Many consumers are finding it difficult to keep up with their monthly payments, leading to financial stress and potential damage to their credit scores. A news article just this week details that delinquencies are surging with almost 1 in 5 users maxing out. Story here. Impact of Inflation on Small Businesses Inflation has also hit small businesses hard. Operating costs have skyrocketed, squeezing profit margins and pushing some businesses to the brink. This economic environment can lead to personal financial strain for business owners who may have leveraged personal credit to keep their businesses afloat. A news opinion piece this week details inflation hitting 20% and how small businesses are being affected. Story here. America running out of money. An economic specter, the National Debt, is growing at $1 trillion every 100 days. More about this story here. A Solution for Tennessee Residents For Tennessee residents grappling with these financial challenges, the Law Office of T. Verner Smith offers a lifeline. With decades of experience in debt resolution and bankruptcy services, they provide personalized solutions to help individuals regain control of their finances. Whether you're dealing with mounting credit card debt or facing insurmountable business expenses, their expert guidance can help you explore your options and find a path to financial stability. Debt Resolution and Bankruptcy Debt resolution involves negotiating with creditors to reduce the total amount owed, making it more manageable to repay. If debt resolution is not a viable option, bankruptcy may provide the necessary relief by eliminating or restructuring debts under the protection of the court. The Law Office of T. Verner Smith can help determine the best course of action based on your unique circumstances. Why Choose the Law Office of T. Verner Smith? With years of experience and a deep understanding of the complexities of debt and bankruptcy law, T. Verner Smith and his team offer compassionate and effective support. They work diligently to ensure that clients understand their rights and options, providing a clear path forward during difficult times. If you're struggling with debt, don't wait until it's too late. Contact the Law Office of T. Verner Smith today to schedule a consultation and take the first step towards financial freedom. Call (731) 423-1888 to schedule a free consultation today. In recent times, families across the West and Middle Tennessee regions, like many across the United States, have faced a complex web of financial pressures that extend beyond the immediate impacts of the COVID-19 pandemic and natural disasters. Rising inflation, wage stagnation, home and food costs, and increasing credit card debt have compounded these challenges, squeezing household budgets even further.

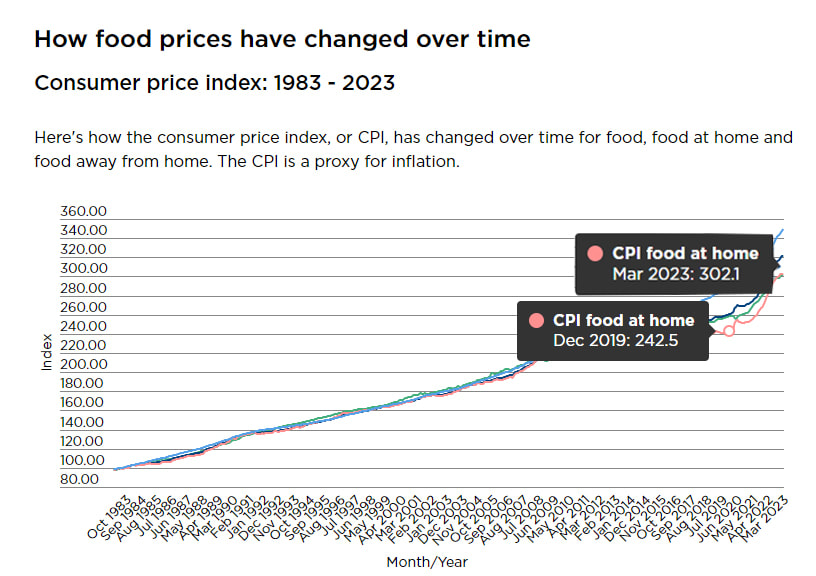

Rising Inflation: The cost of living has surged, particularly due to rising rents, which have been a significant driver of inflation. The consumer price index (CPI) increased by 0.3% in just one month, with shelter accounting for more than two-thirds of this rise. Additionally, food prices rose by 0.4%, marking the most significant increase in a year, partially blamed on winter storms. This inflation dynamic is slowing but remains a persistent concern for economic policymakers and families alike. (1) Pandemic-era Inflation Causes: The sharp rise in inflation experienced in 2021, peaking at about 9% in June 2022, can be attributed to several factors including massive government spending in response to COVID-19, demand surges as the economy reopened, supply chain disruptions, and rising commodity prices. These factors, combined with labor market tightness, have put upward pressure on wages and prices. Initially, energy and food prices and supply chain disruptions were the primary inflation drivers, but as these pressures eased, tight labor markets and wage pressures became more dominant. (2) Comprehensive Impact of Inflation: The inflation experienced was a result of demand-pull inflation, where demand outpaces supply, cost-push inflation, resulting from rising raw material costs, and built-in inflation, where wage demands increase to maintain lifestyles amid rising costs. This multi-faceted inflation has particularly affected essential spending areas like groceries, gas, housing, and cars, with low-income households feeling the greatest impact due to a higher proportion of income going towards necessities. (3) In light of these challenges, legal and financial advisement becomes crucial for those struggling under the weight of financial pressures. The Law Office of T. Verner Smith is committed to providing expert guidance and support through these times. Whether it's navigating debt resolution, addressing credit card debt, or exploring other legal avenues to manage financial difficulties, our office is here to assist families and individuals in finding a path forward. Our team understands the complex interplay of factors currently impacting household finances and stands ready to offer the compassionate and comprehensive support needed to address these issues. For those in West and Middle Tennessee seeking help to navigate these difficult financial waters, please reach out to the Law Office of T. Verner Smith for a consultation today at (731) 423-1888. Our experience in debt resolution and legal financial advisement can provide the necessary guidance to explore all available options, helping you to make informed decisions towards a more stable financial future. Food prices have been on a steady rise over the last four years, and the trend seems to be continuing. In March 2023, the increase in food prices from the previous year was 8.5%, and in February it was even higher at 9.5%. This is the fastest rise in food prices over any four-year period in our history.

One contributing factor to this trend is 'shrinkflation'. This is a phenomenon where manufacturers reduce the size of their product packaging while keeping the price the same. The result is that consumers end up paying the same price for less product. If you take a moment to look at food packaging, you'll likely notice that it has become narrower, and the amount of product inside has decreased. This is happening across most sectors, not just food. There are many reasons for this trend, including rising costs of ingredients, transportation, and labor. As these costs increase, manufacturers are finding it difficult to maintain the same margins without passing the costs onto consumers. While there are no easy solutions to this problem, it's important for consumers to be aware of the trend and to make informed decisions when purchasing products. This could mean shopping around for better deals, buying in bulk, or choosing products with more value for their money. Is your household facing a financial crisis due to these changes and are you ready to consider your legal options? The law office of T. Verner Smith may have answers to your mounting financial problems. Through financial restructuring, debt resolution, or legal options including but not limited to bankruptcy, there are ways to relieve the pressure and chart a path to a better future. Don't be embarrassed, don't be hesitant, you are not alone, and taking action now is the smart approach. Call us at (731) 423-1888 and schedule a free consultation. |

Verner smith blogCall us at (731) 423-1888 Archives

May 2024

Categories

All

|

No attorney-client relationship is established by contacting the firm; No confidential info should be sent via the internet; No legal advice is given on the site.

Privacy Policy - Website Disclaimer

Privacy Policy - Website Disclaimer

RSS Feed

RSS Feed